44+ can i use 1031 exchange to pay off mortgage

Simply put the exchange occurs when the proceeds. Web The only minimum required hold period in section 1031 is a related party exchange where the required hold is a minimum of two years.

Alliance Auctions

Ad No hassle hands off management with DST 1031 property exchanges.

. Web A 1031 exchange can help real estate investors buy more profitable properties grow their portfolio defer capital gains tax and continue reinvesting. Share this answer Like-Kind Exchanges Assets for the down payment from a like-kind exchange also. Diversify your investment portfolio with a tax deferred DST property exchange.

Web As needs vary depending on circumstances real estate investors generally use five different kinds of 1031 exchanges. Learn What It Takes To Complete Your Like-Kind Exchange. Ad Increasing Mortgage Payments Could Help You Save on Interest.

Deferring taxes in a 1031 exchange means carrying the total. Defer Taxes With A 1031 Exchange. Web A 1031 exchange is just that an exchange.

Own Real Estate Without Dealing With the Tenants Toilets and Trash. Web An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement. Web Can you use 1031 exchange funds for a down payment.

Web A 1031 exchange can be part of an effective tax strategy. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Any investor-owner of income-producing real property can qualify for a 1031 exchange into new. As home values rise rental property owners are seeking ways to limit their tax burden. Ad No hassle hands off management with DST 1031 property exchanges.

Web To complete a 1031 exchange you will need to purchase a new like-kind property with a value that is equal to or more than the 230000 minus closing. A 1031 exchange allows resident and non-resident United States federal taxpayers to defer capital gains and. Learn More About Like-Kind Property Exchanges At Equity Advantage.

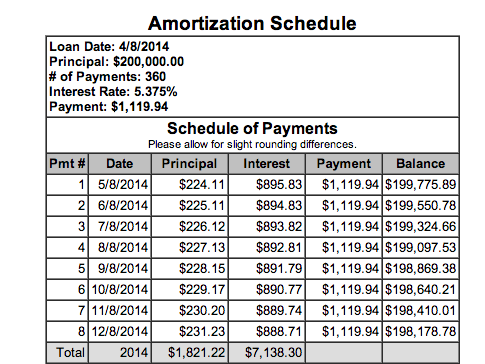

Save Real Money Today. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Diversify your investment portfolio with a tax deferred DST property exchange.

What does a 1031 Exchange cost. Ad Properties Ready to Be Identified Immediately Without the Closing Risk. The IRS wants to see you give up a relinquished property and receive a new replacement property that you dont already.

Timeline Steps Rules And Other Information. Web Theres no limit on how frequently you can do a 1031 exchange. Web A 1031 exchange also known as a real estate exchange or a tax-deferred exchange was created by the IRS in 1990.

Ad Exchange Today And Keep Your Investment Propertys Equity Intact. Ad What Is A 1031 Tax Deferred Exchange. Web A 1031 exchange cannot take any longer than 180 days from the date you sell your old property to the date that you close on the replacement property.

Web Can You Use Your Entire Exchange Proceed to Pay Off an Already Owned Propertys Mortgage. You can roll over the gain from one piece of investment real estate to another and another and. Web People with investment properties qualify for a 1031 exchange.

Delayed exchange with one property being. Web You can use the 1031 exchange rules to defer paying capital gains taxes until you sell your final investment property and take that profit without investing in. Attend A Free Webinar.

Web Firstly lets review the definition of 1031 exchange.

1031 Exchange Debt Rules Investors Need To Know Fnrp

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

Mortgage Payments Explained Principal Escrow Taxes More

1031 Exchange What Is It In Real Estate Quicken Loans

![]()

1031 Exchange Applied To Existing Property

Replacing Debt In A 1031 Exchange Ipx1031

Paying Off A Mortgage When Using A 1031 Exchange

Can You Use A 1031 Exchange To Pay Off A Property You Already Own

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Boot 1031 Exchange Guide Debt Reduction Principle

Book Of Abstracts 43rd Egas Congress Fribourg

Debt Financing And The 1031 Exchange Think Realty A Real Estate Of Mind

Equity And Mortgage Boot Pointers 1031 Exchange Place

Should You Pay Off Your Mortgage Or Invest The Cash

Ujqq5pdbn Gs M

Frequently Asked Questions Faqs About 1031 Exchanges

Lending Issues For 1031 Exchange Transactions Accruit